The 5-Second Trick For 501c3

Table of ContentsHow Irs Nonprofit Search can Save You Time, Stress, and Money.The 7-Second Trick For Irs Nonprofit SearchThe Ultimate Guide To Not For ProfitGetting My Npo Registration To WorkSome Known Details About Non Profit Organization Examples Irs Nonprofit Search for BeginnersSome Known Details About 501c3 Nonprofit Our Irs Nonprofit Search DiariesIndicators on Non Profit Organizations List You Should Know

Integrated vs - non profit organizations list. Unincorporated Nonprofits When people believe of nonprofits, they commonly think about bundled nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, as well as other formally produced organizations. However, lots of people take component in unincorporated not-for-profit associations without ever before recognizing they've done so. Unincorporated nonprofit associations are the outcome of 2 or more individuals collaborating for the function of supplying a public benefit or solution.Private foundations may include family foundations, private operating foundations, as well as company structures. As noted above, they usually don't provide any kind of solutions and also rather make use of the funds they raise to support various other charitable companies with service programs. Exclusive foundations additionally have a tendency to need more startup funds to develop the organization in addition to to cover lawful charges and various other recurring expenses.

Not For Profit Organisation - The Facts

The properties stay in the trust fund while the grantor lives and the grantor may handle the assets, such as buying and also marketing supplies or realty. All properties deposited right into or acquired by the trust continue to be in the count on with earnings distributed to the marked recipients. These trust funds can endure the grantor if they include a stipulation for ongoing monitoring in the paperwork utilized to establish them.

What Does 501c3 Organization Mean?

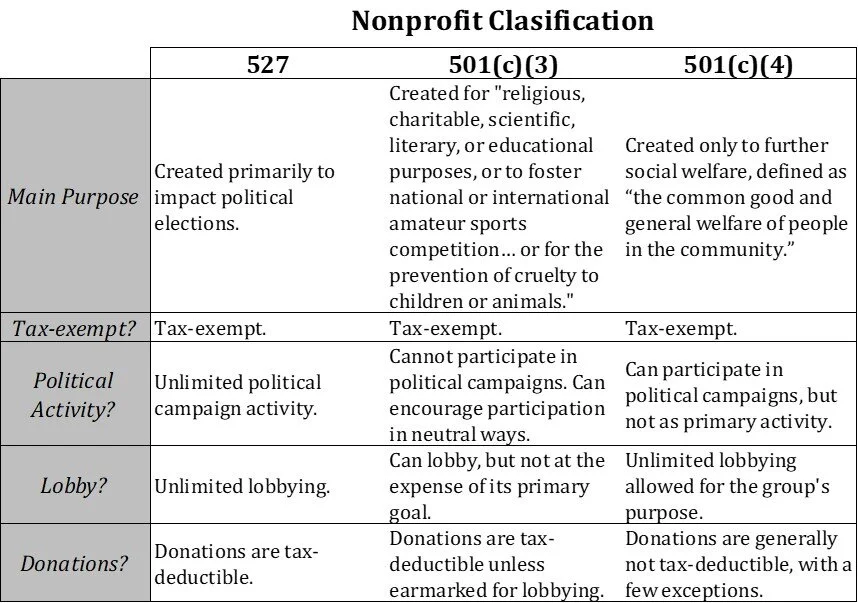

You can hire a trust fund lawyer to aid you develop a charitable trust fund and also encourage you on just how to manage it relocating forward. Political Organizations While many various other kinds of not-for-profit companies have a minimal capability to get involved in or supporter for political activity, political companies run under various policies.

4 Easy Facts About Non Profit Organizations Near Me Described

As you examine your alternatives, be sure to seek advice from with an attorney to figure out the very best strategy for your organization and also to ensure its appropriate configuration.

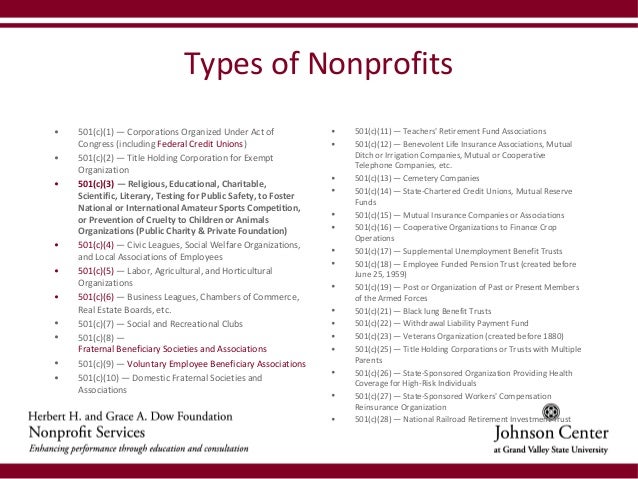

There are lots of types of not-for-profit organizations. These nonprofits are normally tax-exempt since they work towards the public passion. All properties and also revenue from the not-for-profit are reinvested into the organization or given away. Relying on the not-for-profit's subscription, mission, and nonprofit sector structure, different classifications will apply. Nonprofit Company In the USA, there more than 1.

The Definitive Guide to Non Profit Organizations List

Some examples of widely known 501(c)( 6) organizations are the American Farm Bureau, the National Writers Union, and also the International Organization of Fulfilling Planners. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or recreation clubs.

3 Easy Facts About Not For Profit Described

501(c)( 14) - State Chartered Credit Union and also Mutual Reserve Fund 501(c)( 14) are state legal credit report unions and mutual book funds. These organizations offer economic services to their members as well as the community, normally at affordable prices.

In order to be qualified, at the very least 75 percent of members have to be existing or past participants of the USA Armed Forces. Financing comes from contributions and government grants. 501(c)( 26) - State Sponsored Organizations Offering Wellness Insurance Coverage for High-Risk Individuals 501(c)( 26) are nonprofit companies developed at the state level to supply insurance for risky individuals that might not be able to get insurance policy through other means.

The 2-Minute Rule for Not For Profit

501(c)( 27) - State Sponsored Workers' Compensation Reinsurance Organization 501(c)( 27) nonprofit organizations are created to give insurance coverage for employees' payment programs. Organizations that offer employees settlements are needed to be a member of these organizations and pay charges.

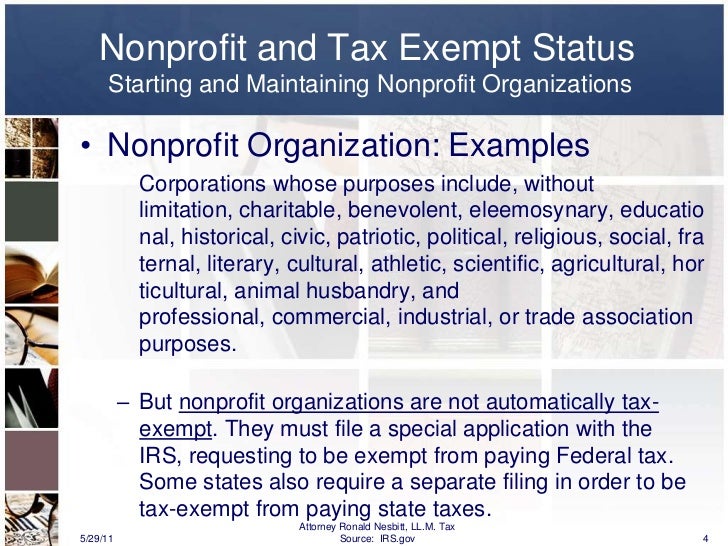

A not-for-profit firm is a company whose purpose is something besides making an earnings. google for nonprofits. A not-for-profit donates its income to achieve a certain objective that benefits the general public, as opposed to distributing it to investors. There are over 1. 5 million nonprofit companies registered in the US. Being a not-for-profit does not imply the organization will not earn a profit.

A Biased View of 501c3

Nobody individual or team owns a not-for-profit. Properties from a nonprofit can be offered, but it benefits the whole organization rather than people. While anyone can include as a nonprofit, just those that pass the strict requirements set forth by the federal government can achieve tax excluded, or 501c3, standing.

We go 501c3 organization over the actions Extra resources to becoming a not-for-profit additional into this page.

Some Known Details About 501c3 Nonprofit

The most essential of these is the capability to obtain tax obligation "excluded" standing with the internal revenue service, which allows it to get donations devoid of gift tax obligation, allows benefactors to subtract contributions on their tax return and exempts a few of the company's activities from income tax obligations. Tax exempt condition is really vital to many nonprofits as it motivates contributions that can be utilized to sustain the objective of the company.